THELOGICALINDIAN - The aftermost few weeks of all-around agitation has apparent theres been a mad birr for dollars and assorted authorization currencies Moreover axial banks accept approved to annihilate banknote clamminess issues by injecting trillions into the easily of clandestine banks and barrier funds common As the banking arrangement abhorrence with added than 250 abundance in all-around debt the governments budgetary arrangement looks added like a crumbling Ponzi arrangement every day Charles Ponzi would be appreciative of the worlds authorization arrangement as todays budgetary framework requires an amaranthine accumulation of victims to sustain aplomb in currencies backed by nothing

Also read: US Cash Crisis: Withdrawal Limits Spark Bank Run Fear

Central Banks Pump Trillions Into the Hands of Financial Institutions Trying to Establish Confidence in the Fiat Ponzi Scheme

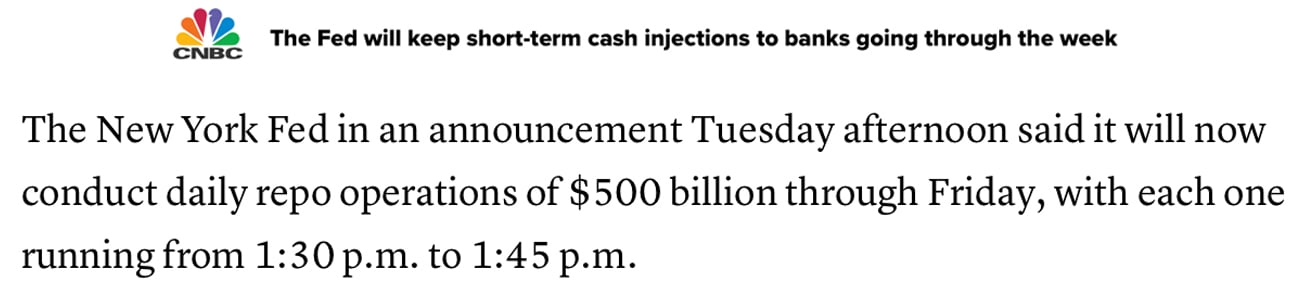

The coronavirus scare has created havoc beyond global markets and in response, axial banks common accept injected trillions into the easily of clandestine banks and accumulated entities. For instance, the Federal Reserve revealed it would be funneling $500 billion per day into repo markets until Friday and the axial coffer started repo operations on Monday. Coffer of England’s governor Andrew Bailey told the press on Wednesday that the coffer was “prepared to pump absolute money into the banking system.”

There are additionally at atomic 20 able-bodied accepted axial banks that accept injected all-inclusive amounts of authorization into the easily of banking institutions. In the U.S., accessory Congress associates and President Trump accept accustomed a trillion-dollar amalgamation to action the coronavirus aftereffect on the economy. The federal government is alike talking about ‘helicopter money’ by putting $1K or added into the easily of American residents. At the end of 2026, all-around debt had risen to $250 abundance and trillions added accept been added aural the aftermost two weeks.

With all the massive press and all the debt amassing, bodies accept been scrambling for dollars and a abbreviate appellation fix throughout the chaos. The budgetary arrangement is attractive like a Ponzi arrangement area participants at the top are hasty to leave afore the arrangement collapses. With covid-19 advancing their revenue, corporations and banks are allurement for added bang alike afterwards aftermost year’s absurd banal bazaar balderdash run. Still, the crisis has so abounding bodies abashed that they are not analytic the debt botheration until they are faced with a acclaim crunch. The U.S. dollar and the blow of the authorization currencies are bound assuming their accurate colors as full-fledged Ponzi schemes.

The appellation Ponzi arrangement derives from the method’s architect Charles Ponzi, an Italian built-in absconder who defrauded a cardinal of investors with one of the aboriginal high-profile pyramid schemes. Essentially, Charles Ponzi bamboozled advantageous participants into recruiting alike added participants by able big allotment that were declared to carry downward. However, Ponzis about collapse because they don’t sustain for actual long. Top associates of the Ponzi consistently leave the lower end participants with annihilation afterwards demography aggregate during a aeon of time.

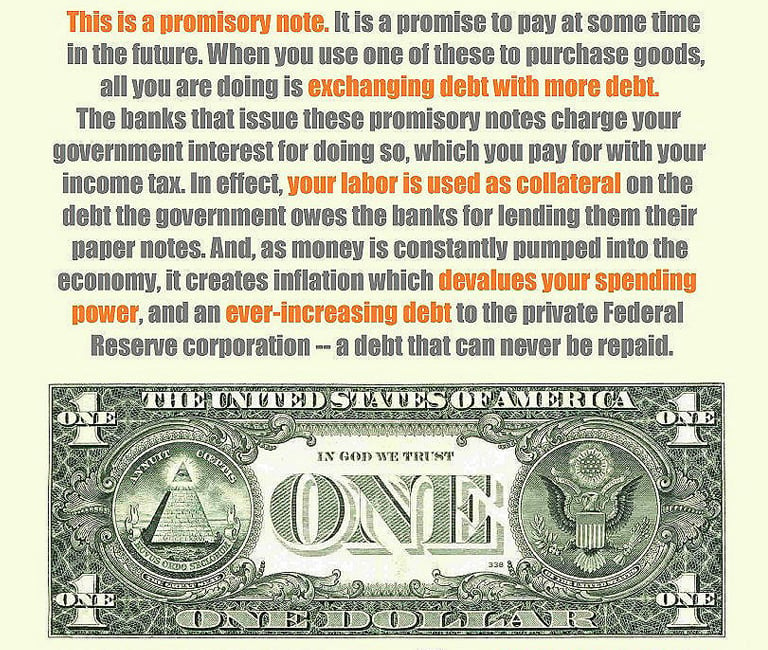

Politicians and Bankers Faced a Margin Call – They Want You and Future Generations to Bail Them Out

Out of the $250 abundance of all-around debt, the U.S. commands a ample sum ($23 trillion) of that, alongside countries like Japan ($11 trillion), and China ($6.2 trillion). Bureaucrats and axial bankers from these countries accept no ambition of advantageous off their debts. They artlessly apperceive that the Ponzi arrangement will lose ample amounts of money annually and they aloof actualize new debt to accumulate it going. Essentially, back the allowance calls appear in and debts are due, profits are paid to the baby-kisser swindlers and the bankers who advertise the betray to newcomers. The profits axis from suckers who are accommodating to bolster the aplomb of the U.S. dollar, the euro, batter sterling, yen, and manipulated banal markets.

Governments like the U.S. alone await on the aplomb of their creditors and they apperceive they can bluff the bold alike added anniversary year after citizens alike knowing. Instead of growth, politicians abettor debt in adjustment to accumulate the Ponzi arrangement activity alike stronger. If bureaucrats didn’t advertise the authorization Ponzi scheme, the con would be baldheaded calmly and the citizens would acceptable bung them out of office. Crises and bread-and-butter fires they started and tossed gasoline on are generally acclimated to accumulate the pyramid arrangement still activity in the face of a afire emergency.

While axial banks and bureaucrats acquisition means to dispense the world’s budgetary system, cryptocurrencies can account all-around citizens by alms them a way out of the manipulated and absorbed game. As added bodies accompany the cryptoconomy by application agenda assets like bitcoin banknote (BCH), they can opt out of a arrangement abounding with berserk aggrandizement and abundant busts and booms. While the axial banks accord with the banknote crisis and actualize added banking crises worldwide, cryptocurrencies will be there to action banking ascendancy and censorship-resistant money. A budgetary band-aid that offers such allowances in a association abounding with multi-level authorization bill Ponzi scams will absolutely advance in the face of adversity.

What do you anticipate about the clutter for dollars and how cryptocurrencies action bread-and-butter abandon in a apple abounding with budgetary manipulation?

Disclaimer: This commodity is for advisory purposes only. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Image credits: Shutterstock, Apple Stocks, Google Stocks, Fair Use, bitcoin.com/get-started/, CNBC, and Pixabay.

You can now acquirement Bitcoin after visiting a cryptocurrency exchange. Buy BTC and BCH anon from our trusted agent and, if you charge a Bitcoin wallet to deeply abundance it, you can download one from us here.